Divorce or Dissolution of Marriage

Divorce can be hard. But our vision is to see you through to the other side and help you envision a better tomorrow.

Whether it is using our Certified Divorce Financial Valuation process along with your attorney or using our alternative in-house mediation path, we believe a compassionate, fair, and dignified approach is better for all involved. When guided by a skilled wealth advisor, there is a strategic and amicable path to protect and optimize your financial assets during this challenging life transition. Whatever stage you are in, whether pre-divorce or post-divorce, hiring a financial advisor at any stage in the process can be beneficial in many ways.

Pre-Divorce or Dissolution

If you’re facing divorce, it can be crucial to consider your financial arrangements as soon as possible. Separating income and assets can be significant work, decisions can be difficult, and the process can be lengthy and costly.

Pre-Divorce or Dissolution

If you’re facing divorce, it can be crucial to consider your financial arrangements as soon as possible. Separating income and assets can be significant work, decisions can be difficult, and the process can be lengthy and costly.

A reliable partner and financial trusted advisor

If you’re facing divorce, it can be crucial to consider your financial arrangements as soon as possible. Working with a CDFA® (Certified Divorce Financial Analyst) can save time, money, and stress.You’ll want to consider the future impacts on your finances, the tax ramifications, and more. Decisions made today can continue to impact your life for years to come and affect how you start your next chapter.

A customized financial strategy designed to meet you where you are

It’s our role to provide education and break down complicated financial issues so that each spouse can understand their financial circumstances. Some items we will review in particular:

- Expected levels of income and budgets post-divorce

- Marital assets and their values

- Potential tax impacts on your assets

- Valuation of pensions

- Mortgage qualifications

If you were a spouse not actively involved in financial matters while married, I encourage you to get organized and engaged in separating assets before your divorce for a fair settlement for both parties. It’s important to us that both parties feel confidence and security in their financial future moving forward.

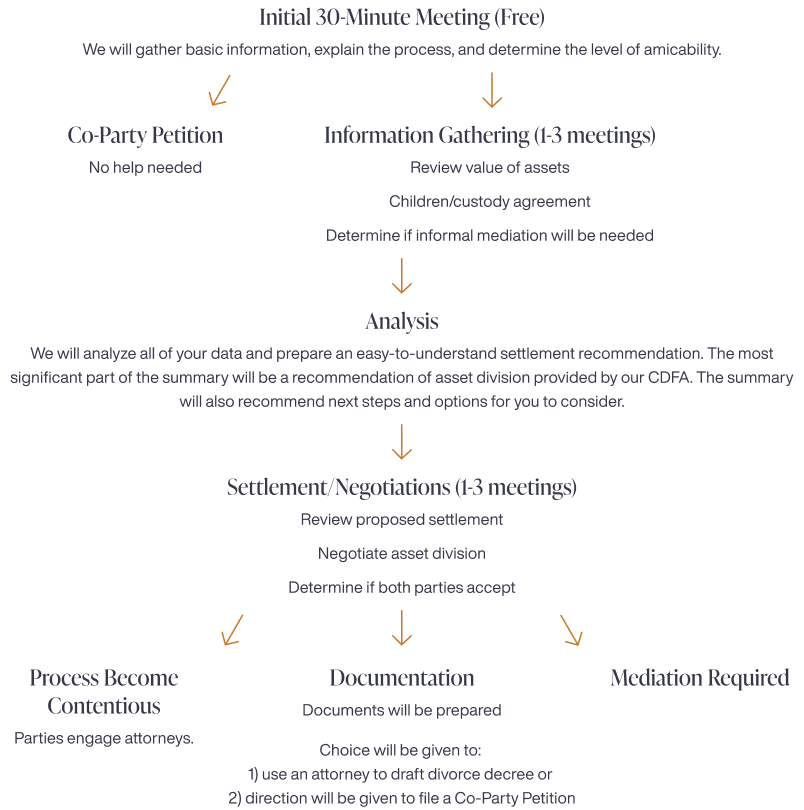

Using a certified mediator with Blue Anchor

Using a certified mediator (NACM) can help you maintain control of the process of decision-making. By staying in control (and out of court), both parties have the chance to be more satisfied with the outcomes. Additionally, parties are more likely to abide by mutually agreed upon decisions. Over 85% of the time if both parties enter mediation in good faith, a mutual agreement can be made.

A reliable partner and financial trusted advisor

If you’re facing divorce, it can be crucial to consider your financial arrangements as soon as possible. Working with a CDFA® (Certified Divorce Financial Analyst) can save time, money, and stress.You’ll want to consider the future impacts on your finances, the tax ramifications, and more. Decisions made today can continue to impact your life for years to come and affect how you start your next chapter.

A customized financial strategy designed to meet you where you are

It’s our role to provide education and break down complicated financial issues so that each spouse can understand their financial circumstances. Some items we will review in particular:

- Expected levels of income and budgets post-divorce

- Marital assets and their values

- Potential tax impacts on your assets

- Valuation of pensions

- Mortgage qualifications

If you were a spouse not actively involved in financial matters while married, I encourage you to get organized and engaged in separating assets before your divorce for a fair settlement for both parties. It’s important to us that both parties feel confidence and security in their financial future moving forward.

Using a certified mediator with Blue Anchor

Using a certified mediator (NACM) can help you maintain control of the process of decision-making. By staying in control (and out of court), both parties have the chance to be more satisfied with the outcomes. Additionally, parties are more likely to abide by mutually agreed upon decisions. Over 85% of the time if both parties enter mediation in good faith, a mutual agreement can be made.

Post-Divorce or Dissolution

Perhaps your divorce is already finalized, and now you’re looking for the next financial steps. You may have received court orders or qualified domestic relation orders (QDRO) and are unsure how to handle them.We will work with you to disentangle your assets, understand the court orders, and communicate with different agencies and custodians. Executing these steps in the proper order can save you a lot of time, money, and stress.

Post-Divorce or Dissolution

Perhaps your divorce is already finalized, and now you’re looking for the next financial steps. You may have received court orders or qualified domestic relation orders (QDRO) and are unsure how to handle them.We will work with you to disentangle your assets, understand the court orders, and communicate with different agencies and custodians. Executing these steps in the proper order can save you a lot of time, money, and stress.

Your next chapter

You’ll want to plan for your financial future now, and we can help you take that step.

Our services encompass financial planning, investment advice, and continuous education in financial literacy to empower you with the knowledge and confidence to make informed decisions regarding your financial future.

Throughout this challenging time, we’re dedicated to providing you with compassionate financial guidance, ensuring that your interests and emotional well-being are at the forefront of every decision we make together.

Your Next Chapter

You’ll want to plan for your financial future now, and we can help you take that step.

Our services encompass financial planning, investment advice, and continuous education in financial literacy to empower you with the knowledge and confidence to make informed decisions regarding your financial future.

Throughout this challenging time, we’re dedicated to providing you with compassionate financial guidance, ensuring that your interests and emotional well-being are at the forefront of every decision we make together.